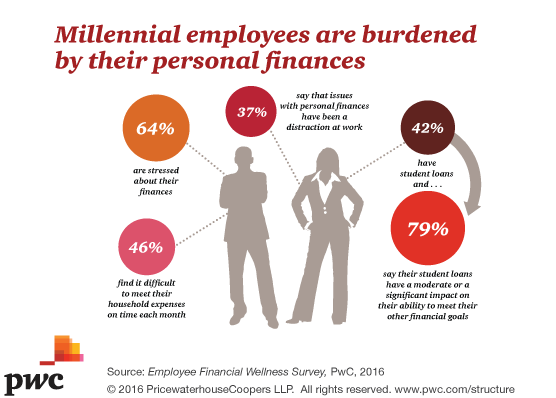

Financial stress rates in the US are among the highest they have been over the last five years, with workers facing more financial burdens and increased debt, according to a new survey. More than half (52 percent) of respondents from PwC US’s 2016 Employee Financial Wellness Survey say they are stressed about finances, and 45 percent report that their stress has increased over the last 12 months. Increased financial stress levels are being felt more by millennials (64 percent) than any other generation surveyed.

“Many employees aren’t feeling confident about their finances,” said Kent E. Allison, leader of PwC’s Employee Financial Education and Wellness practice. “A combination of factors are adding to stress levels. Despite lower energy costs, salaries are barely keeping pace with the rise in cost of living, causing an additional strain on employee budgets that were already stretched thin. The housing market has only moderately improved and in many places home values still remain far below pre-recession prices despite interest rates being at historic lows. Couple that with the recent volatility in the stock market and it is no wonder employee confidence is waning.”

Millennials burdened by student loans

Employees impacted by student loans are in worse financial shape than other employees. This stress is perhaps most acutely felt by millennials since 42 percent of millennial survey respondents indicated that they have a student loan, and 79 percent say that their student loans are having a moderate or significant impact on their ability to meet their other financial goals. Workers whose finances are impacted by student loan debt are less productive, have more financial stress, are more likely to find it difficult to meet household expenses and are less confident in their retirement preparedness.

Workers saving less for retirement

Employee retirement savings are also an area of concern for employers. PwC data shows that nearly half of all workers (47 percent) have saved less than $50,000 for retirement and 28 percent of workers are saving less for retirement than last year. Given this picture, it’s not surprising more workers are postponing retirement.

Financial stress impacts productivity at work, relationships and health

More employees are spending more time dealing with finances in the workplace, which is impacting their overall productivity and affecting life outside of work. In fact, 28 percent of respondents said personal finances have been a distraction at work (compared to 20 percent last year). Among them, 46 percent spend three or more hours at work per week dealing with or thinking about issues related to their finances (compared to 37 percent last year). Twenty eight percent suggest that their health has been negatively impacted by their financial worries, and 23 percent say their relationships at home have been affected.

Employers should pay attention to their employees’ financial wellness

Only 44 percent of those surveyed believe that their employer cares about their financial well-being, however more than half of millennials (54 percent) stated that their loyalty to their employer is influenced by how much their employer cares about their financial well-being.

“With retirement savings worryingly low, now is the time for employers to put effective financial wellness programs into place that focus holistically on the financial well-being of employees and drive behavioral change,” Allison added.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Financial Planning, Staffing